Mortgage Interest Rate Predictions for 2024 and 2025

If you’re pondering whether mortgage rates will lower soon, you’re not alone. Whether you’re a first-time buyer, a move-up buyer, or considering refinancing, understanding where mortgage rates are headed is crucial. I’m Hannah Eser, a mortgage adviser and rookie investor with two properties. Today, I’ll help you navigate the current and future mortgage rate landscape.

Current Mortgage Rate Situation

Currently, mortgage rates are higher than they’ve been in the past couple of years. This increase is due to the Federal Reserve raising rates 11 times over the past two years, reaching the current federal funds rate of 5.25% to 5.50%. Although the federal funds rate isn’t the same as mortgage rates, it significantly influences them.

Factors Influencing Mortgage Rates

- Federal Reserve’s Monetary Policy: The Fed’s decisions on interest rates play a crucial role in shaping mortgage rates.

- Inflation: Rates tend to be higher during periods of economic growth and inflation. Conversely, when economic growth slows, rates generally decrease.

- Global Events: International events can impact U.S. mortgage rates due to our global economic connections.

When Will Mortgage Rates Go Down?

Experts are predicting a potential decrease in mortgage rates. Here’s what you need to know:

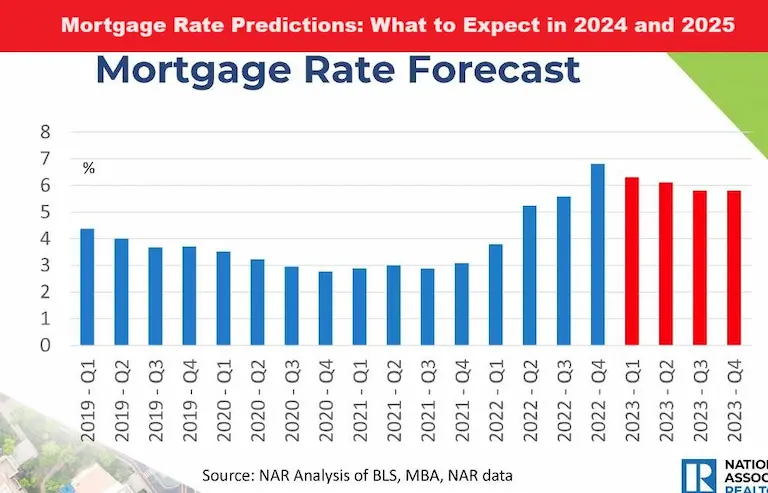

- Federal Reserve’s Plans: The Fed aims to bring inflation down to 2%. To achieve this, they’ve been raising interest rates steadily. They plan to lower rates once in 2024 and up to four times in 2025. Typically, mortgage rates are about 1.5% to 2% higher than the federal funds rate. So, if the Fed’s rate is around 3% by the end of 2025, mortgage rates might be around 5%.

- Rate Cuts Timeline:

- 2024: Economists expect the first rate cut in September, with the possibility of a second cut in December. However, the Fed has only confirmed one cut for 2024.

- 2025: The Fed plans up to four rate cuts. This could potentially make a significant difference for those waiting for lower rates.

Economic Factors and Home Prices

While lower mortgage rates are anticipated, it’s important to note that home prices might rise as rates decrease. During the pandemic, lower rates spurred a surge in homebuyers, driving up prices. With more buyers entering the market as rates drop, home prices could increase. If you can afford a home now, you might benefit from lower future rates through refinancing, even if home prices rise.

What Should You Do Now?

Here are some tips to navigate the current mortgage rate environment:

- Stay Informed: Keep up with the latest news and economic updates from reliable sources.

- Shop Around: Different banks and lenders offer various loan products. Explore options to find the best fit for you.

- Consider Locking In Your Rate: Some lenders offer “lock and shop” loans, allowing you to lock in a rate while shopping for a home. This can be advantageous if you’re sensitive to rate changes.

- Stay Flexible: Economic conditions and rates fluctuate. Have multiple plans and scenarios ready to adapt to changes.

Final Thoughts

The best time to buy a home is when you’re ready, not necessarily when rates are at their lowest. The economy and mortgage rates will continue to evolve. If your financial situation supports buying now, it might be a wise decision to jump in and benefit from future rate drops through refinancing.

Ray Brown’s revised quote: “The best time to buy a home is whenever you are able.”

FAQ

Will mortgage interest rates go down in 2024?

Experts predict a possible decrease in mortgage rates in 2024, with the first-rate cut expected in September. However, the exact timing and extent of these reductions can vary

How will the Federal Reserve’s actions affect mortgage rates in 2024 and 2025?

The Federal Reserve plans to lower rates once in 2024 and up to four times in 2025, which could lead to a decrease in mortgage rates. Mortgage rates typically trail the Fed’s actions by 1.5% to 2%.

What impact could lower mortgage rates have on home prices?

Lower mortgage rates may lead to higher home prices due to increased buyer demand. The surge in homebuyers could drive prices up, similar to trends observed during the pandemic.

How might falling mortgage rates impact home prices?

Lower mortgage rates might lead to higher home prices due to increased demand. If you can buy now, you might benefit from lower prices before rates drop.

“Why should we trust predictions for 2025 when the unpredictable global economy can affect mortgage rates drastically every year?”

“Valid point! While forecasts can’t be guaranteed, studying trends and economic indicators helps us make informed predictions.”

Will mortgage rates go down in 2024? What indicators suggest a decrease, if any?

It’s possible, depending on economic factors like inflation rates and housing market trends. Stay informed for updates.

Insightful content on mortgage trends! Clear predictions for 2024 and 2025, helpful for buyers and refinancers. Great job!

Additional Info: Factors like inflation rates, economic growth, and global events will influence future mortgage rate trends.

“As a homeowner looking to refinance, I’m closely monitoring the possibility of lower mortgage rates in 2025. Stay informed!”

Good overview of current mortgage rates, but more detailed analysis and sources for rate predictions would enhance credibility.

Comment: “I’m skeptical about the mortgage rate predictions. Economic factors could shift unexpectedly. How reliable are these forecasts?”

Author reply: “It’s understandable to be cautious. Forecasting is based on current trends and data analysis, but external factors can

This post provides a helpful overview of current mortgage rates, but more in-depth analysis or expert insights could enhance it.

Comment: “How can we be certain that mortgage rates will go down in 2024 with rising interest rates?”

Reply: “While predicting rates is uncertain, historical trends suggest market factors may lead to a drop in 2024.”

Engaging insights on the future of mortgage rates with practical advice. Expertly navigates the complexities of the housing market.

Doubt Comment: “Is there a chance of unexpected economic factors causing rates to fluctuate unpredictably instead of a steady decline?”

Author Reply: “While some unpredictability is always possible, current data and trends suggest a gradual decline in rates for

“I refinanced my home in 2023 when rates dropped; it’s uncertain if they’ll dip again in 2024.”

Doubt: “What if unexpected economic conditions arise that could prevent mortgage rates from going down as predicted?”

Reply: “In case of unforeseen events, the mortgage rates may fluctuate. Regular industry updates will address such uncertainties.”

Comment: “What if economic factors unexpectedly worsen in 2024, causing mortgage rates to increase instead of decrease?”

Author Reply: “While it’s possible for unforeseen economic shifts, experts predict stability in rates given current projections and policies.”

Question Comment: Will mortgage rates decrease before 2025 due to the current economic situation? And how will it affect homebuyers?

Author Reply: While predicting exact rates is challenging, economic indicators suggest potential rate decreases in 2024. Keep an

Doubt Comment: “Given the current economic trends, is there a possibility that external factors could still cause mortgage rates to decrease?”

Author Reply: “External factors like global economic shifts could indeed influence mortgage rates. Constant monitoring is necessary for accurate predictions

Comment: Will mortgage rates really decline in 2024 or should we expect them to remain stable or even increase further?

Reply: While predictions suggest a slight dip in rates, market uncertainties may impact any significant changes. Stay updated.

“My recent experience refinancing in 2024 showed moderate rate decrease, but experts predict further drops in 2025.”